Good morning!

This edition of the Very Big Things Newsletter features:

The #MiamiTech company bringing ads to rideshare vehicles

How to check if your PC will run Windows 11

Google calls on Android developers to support more form factors

The new hot space in cyber funding is APIs

And the global IPO market continues to boom

Today is Monday, June 28, 2021.

1. #MiamiTech

Miami Beach-based Alfi partners with All-Niter to bring targeted advertising tablets to rideshare drivers (Refresh Miami)

AI-powered AdTech firm Alfi (Nasdaq: ALF) has announced its partnership with All-Niter to fulfill and distribute 10,000 tablets to be deployed in Uber and Lyft vehicles nationwide. The tablets will use computer vision and machine learning to show targeted ads to rideshare customers.

The use of the tablets will provide supplemental income to drivers without compromising riders’ personal information. All-Niter will laser cut the backboard and plastic elements that hold the tablets in place and assemble them for “plug-and-play” installation.

Alfi develops tech that is disrupting the out-of-home advertising market. Images from cameras installed on advertising devices like tablets or large screens are fed into Alfi’s proprietary algorithm and its software determines factors like a user’s age and gender to display the most relevant ad.

Based in Miami Beach, Alfi boasts a diverse roster of clients, from rideshare drivers to retail complexes. It has a global footprint that includes a major mall in central London and the largest out-of-home provider in Brazil. The company has 50 employees.

2. Windows 11

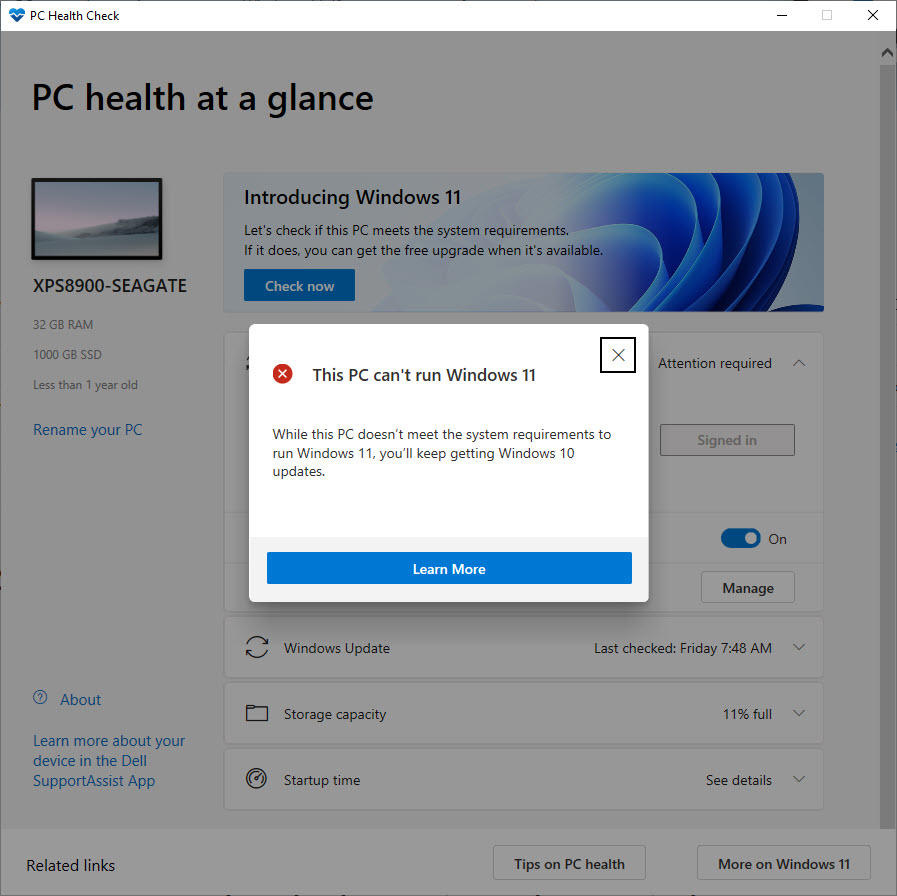

Will your PC run Windows 11? Even Microsoft can’t say for sure (ZDNet)

Microsoft can't quite get its upgrade story straight. And the clash between the company's engineering decisions and its marketing plan is about to cause screams of outrage from customers who will discover that their new or nearly new hardware just isn't good enough, in Microsoft's eyes.

You need a 64-bit Intel or AMD processor running at a speed of at least 1 GHz with 2 or more cores, or, on Arm-based PCs, a compatible System on a Chip (SoC). The biggest change from Windows 10 specs is that 32-bit CPUs are no longer supported. You also need at least 4 GB of RAM and 64 GB of storage.

The two biggest stumbling blocks for PCs involve support for an essential security feature called a Trusted Platform Module (TPM) and support for a minimum CPU generation. The system requirements page says you'll need a TPM version 2.0 and the Microsoft engineering document includes a full list of supported CPUs from AMD, Intel, and Qualcomm.

3. Android

Google to Android devs: Support more form factors, get a higher sales cut (Ars Technica)

There are 3 billion active Android devices in circulation. The vast majority of them are phones, so for app developers not interested in the wider Android ecosystem, that means create a phone app and you're done. Now, however, Google would like more developers to support those other connected devices.

Google's master plan is called the Play Media Experience Program, and it offers this proposition to developers: support more Android form factors and Google will take a lower cut of Play Store sales. Media apps focusing on video, audio, or books now have special support targets they can hit that will result in Google cutting fees to 15%.

Google lays out the following requirements for various app types:

Video - high-quality video content for the living room; requires integrations with Android TV, Google TV, and Google Cast

Audio - subscription music and audio services that work everywhere; requires integrations with Wear OS, Android Auto, Android TV, and Google Cast

Books - compelling reading experience on larger screens; optimized experience on tablets, foldables, and integration with the new Entertainment Space

Charging less money is definitely speaking a developer's language but the program is very limited. Only multimillion-dollar apps get a shot at eligibility, and only media apps, and only apps charging real money as opposed to being ad-supported.

4. VC

Investors eye emerging cybersecurity space as APIs explode (Crunchbase)

With VC flowing into the cybersecurity space at a record level, investors continue to hunt for the next big thing. In the last two months, that has meant looking at how applications talk to each other — and how to protect the data and services that flow through them between application programming interfaces, or APIs.

The amount of APIs — including web, mobile and third-party — in use has exploded through the years. A report by Akamai Technologies said 83% of all web traffic now goes through APIs. The proliferation of APIs is in large part due to the growth of “microservices.” Microservices is a style of building apps by loosely coupling services around the app’s main business function.

As companies build their apps, developers integrate them with providers of microservices — things like communication, logistics, and login verification. As more of these microservices become available, developers add them to apps through APIs. Without secure APIs, bad actors can take over accounts or disrupt a company’s business.

Although API security recently has captured investors’ imaginations, it still is a nascent space when compared to other areas of cyber. Companies that describe themselves as securing APIs only have seen about $193.4 million of venture funding in the last 18 months — most of that going to Salt Security — although that is more than triple what the space realized in 2018 and 2019 combined.

5. Markets

The global IPO market has never been hotter than it is right now (Bloomberg)

Companies are racing to public markets like never before. An all-time high of almost $350 billion has been raised in initial public offerings in the first six months of this year, surpassing the previous peak of $282 billion from the second half of 2020.

When the rush for IPOs kicked off last year, stay-at-home tech dominated the scene, seizing on investor interest in anything digital, while SPACs also flooded the market. This year, with stocks continuing to push skyward, the trend has broadened to include renewable-energy companies and online retailers.

The boom has been fueled by a torrent of cash that central banks have pumped into the economy and the rise of individual investors, who are eager to buy a piece of their favorite companies. It’s delivered a windfall for investment banks around the world, who reap the rewards from underwriting and advisory fees.

Still, as long as the stock market is rising, the flow of IPOs is unlikely to dry up, and total proceeds this year are on track to eclipse the record of $420.1 billion set in 2007. The IPO boom is likely to continue for the next six to 12 months.

6. Funding, IPOs, M&As

Visa Buys Tink For $2.2 Billion: Visa has agreed to take over the Swedish fintech open banking platform.

BuzzFeed To Go Public Via SPAC: The digital-media outlet has struck a deal to merge with a SPAC valuing it at $1.5 billion.

Stash Buys PayGrade: The student-aimed fintech unicorn is acquiring the financial literacy startup to help its users invest.

WeRide Bags Over $600 Million: The Chinese robotaxi unicorn startup has raised Series B and C rounds in just five months.

Amazon Web Services Acquires Wickr: AWS is acquiring the secure messaging platform. Terms were not disclosed.

Illumio Closes $225 Million Series F: The self-styled zero trust unicorn is now valued at $2.75 billion.

Figma Raises $200 Million: The software design startup is now worth $10 billion, quintupling its pricetag since last year.

Firebolt Lands $127 Million Series B: The startup has a new kind of cloud data warehouse that promises more efficient analytics.

Incorta Brings In $120 Million: The startup’s analytics platform is designed to speed up data ingestion.

Accept.inc Announce $90 Million: The Denver-based company will scale its digital mortgage lending platform.

Sanity Raises $39 Million: Sanity has built a system to make it easier to repurpose and use content assets.

RoadSync Closes $30 Million Series B: Atlanta-based RoadSync has a logistics-focused financial platform.

Orbion Gets $20 Million Series B: Orbion Space Technology has developed an in-space plasma propulsion system.

Env0 Nabs $17 Million Series A: The startup provides control and governance over the cloud resources delivering code.

Tripp Raises $11 Million Series A: The psychedelic VR meditation startup has raised funds led by Vine Ventures and Mayfield.

Acryl Data Secures $9 Million: The startup is emerging from stealth to commercialize LinkedIn’s tool DataHub.

As always, please feel free to share questions, feedback, or requests for future newsletters.

Cheers!

Eric

#BeAmbitious